Five Game-Changing Banking App Trends for 2025

The banking sector is embracing digital innovation, with mobile apps leading the charge. In 2025, expect transformative features that enhance user experience, security, and accessibility. This article examines five key trends that are shaping the future of mobile banking.

Key Trends Driving Banking Apps in 2025

AI-Powered Personalisation

Artificial intelligence is revolutionising mobile banking by delivering tailored financial insights. Smart assistants offer real-time advice, streamline budgeting, and detect suspicious activity.

How Does AI Improve Banking Apps?

- Chatbots process transactions and answer queries instantly.

- Personalised recommendations optimise spending and savings.

- Predictive tools enhance security by spotting unusual patterns.

For example, a banking app might analyse your habits and suggest ways to save or invest smarter.

Biometric Security Enhancements

As cyber risks grow, banks are adopting advanced biometric authentication. Facial recognition, fingerprint scanning, and voice verification are replacing traditional passwords.

Top Security Features in 2025 Banking Apps

- Multi-factor authentication combines biometrics with one-time codes.

- Behavioural analysis identifies users through unique interaction patterns.

- End-to-end encryption safeguards sensitive information.

Embedded Finance Integration

Embedded finance allows financial services to operate within non-banking platforms, such as e-commerce or ride-sharing apps. Users can access loans or payments without leaving their preferred app.

Why Is Embedded Finance Transformative?

- Financial tools are available instantly within third-party platforms.

- APIs enable seamless integration of banking services.

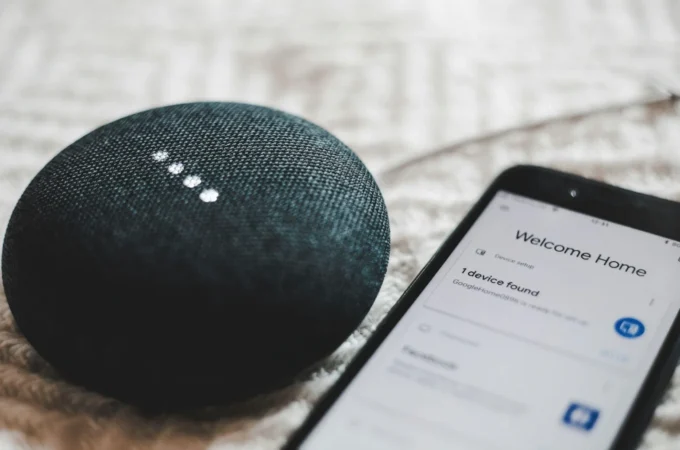

- Super apps integrate banking, shopping, and payments into a single, convenient platform.

For instance, a shopping app might offer instant financing at checkout, simplifying the user experience.

Blockchain and Decentralised Finance

Decentralised finance (DeFi) and blockchain technology enable secure, intermediary-free transactions. In 2025, banking apps will leverage these for faster and more transparent services.

Blockchain’s Impact on Banking Apps

- Smart contracts automate transactions efficiently.

- Instant settlements speed up cross-border transfers.

- Tamper-proof systems reduce fraud risks.

Expect digital wallets and tokenised assets to become standard features in mobile banking.

Open Banking Ecosystems

Open banking, powered by secure APIs, fosters collaboration between banks and third-party developers. This enables the creation of innovative tools that integrate seamlessly with financial institutions.

Benefits of Open Banking

- Users gain better control over their financial data.

- Loan approvals are faster with real-time data access.

- Personalised services reflect individual spending habits.

For example, a budgeting app could connect to multiple banks, offering unified financial insights.

What’s Next for Mobile Banking in 2025?

Mobile banking is evolving into a hub for intelligent, secure, and user-focused financial solutions. In 2025, apps will likely offer:

- Tailored services aligned with personal financial goals.

- Advanced encryption to counter emerging cyber threats.

- Seamless global transactions via blockchain.

- Integrated ecosystems through open banking and embedded finance.

Fintech Innovations Shaping 2025

The latest fintech advancements will redefine mobile banking by embedding cutting-edge technology into daily financial tasks. Key innovations include:

- AI-driven tools for smarter wealth management.

- Voice-activated banking for hands-free transactions.

- Sustainable finance features to track environmental impact.

- All-in-one apps combining banking, payments, and lifestyle services.

We extend our gratitude to WislaCode Solutions for providing the insights for this article. WislaCode Solutions specialises in developing innovative banking apps, building super-apps, web apps, and tools that ease life for teams and customers.