5 Important Tips for First-Time Gold Buyers

Do you want to start investing in gold, but you’re intimidated by all the information out there? Gold can be a rewarding investment, as it both protects your money and has the potential to grow rapidly. It can seem overwhelming for first timers, though, so here are 5 tips first-time gold buyers need to know before they get started.

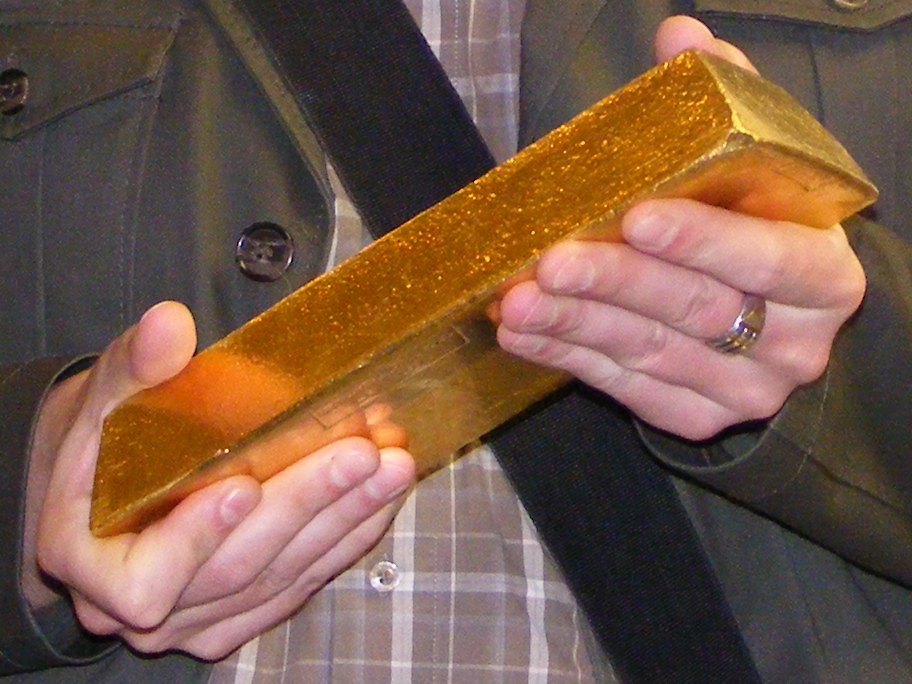

#1 Only Buy Physical Gold Bullion

Other forms of paper gold may come with “cash settlement clauses,” which mean that you can’t demand delivery. The bank you bought it from could simply give you cash instead of gold, especially in a monetary crisis that deflates the value of said cash. Gold is all about protecting your wealth.

#2 Don’t Let Companies Lease Out Your Gold

Make sure the physical gold you buy can’t be leased out by the company or the bank where you store it. Gold leasing is a dubious practice at best, and mostly only practiced by major banks.

Gold leasing is a little more complicated than “leasing” makes it sound.Banks borrow physical gold and then immediately sell it to someone else, sometimes an industrial user, with the promise to pay back the lender sometime in the future with gold from a mining company or refinery. Gold leases tend to get extended again and again, because gold remains a scarce resource. Increasingly, gold experts worry that a shortage could leave anyone with leased gold holding thin air.

One way to avoid the banking system is to use global storage solutions such as Silver Gold Bull, where your gold is held in a separate vault in a secure facility.

#3 Buy Liquid Quantities

You can buy gold in a wide variety of weights, 1/10 oz. to a kilo or more. But it can be difficult to find a place to sell a kilo of gold in a crisis.

The most liquid type of gold bullion is legal tender gold coins such as the Canadian Maple Leaf, American Gold Eagle, or Austrian Philharmonic. They strike the right balance between liquidity and costs.

Generally speaking, the more weight in gold you buy, the lower the fees you pay. Ten 1/10 oz. gold coins are more expensive than a single 1 oz. gold coin. When you buy coins like these from national mints, you pay the spot price of gold, plus fees for the mint and the dealer (which should be no more than 5-6% of spot).

#4 Be Patient

Don’t invest money in gold that you’re going to need in the next five years. No one can guarantee where gold prices will go, but as with any investment, you need to give it time to appreciate. Gold investors do best when they have the freedom to decide when to sell – at high prices.

#5 Consider Investing in Silver

Many investors in precious metals choose to invest a split between gold and silver. Gold is often seen as safer and more stable, while silver has the potential to grow faster (though it can also fall faster). Silver can be a powerful investment tool, and you can often trade gold and silver directly through a gold dealer.

With these tips for buying your first bullion, you’re prepared to become a gold investor. Investing in gold should be simple and straightforward. Reduce your third-party risks, protect your wealth from inflation and monetary crises, and watch its value grow.