Bitcoin Mining Boom Boost up the Chip Cost inflation

As we see, the price of the digital coin called Bitcoin is boosting up; we see the hidden cost in the digital currency is going to be on the higher side. In fact, it is counted as the boom time, and the message is loud and clear. The awareness about the environmental output of creating a huge collection of computer machines that are used to make bitcoin seemed to have been rising high. Even the IT Tech giant company owner Bill Gates has shared the flag concerns that seemed to have pointed out the so-called bitcoin mining users in order to create a huge amount of electricity for each piece of bitcoin. There are several machines and equipment that are seen producing good numbers of bitcoin with the increasing cost. There is so much stuff that has been discussed on this as far as the mining impact is concerned about the cost of chips and other things.

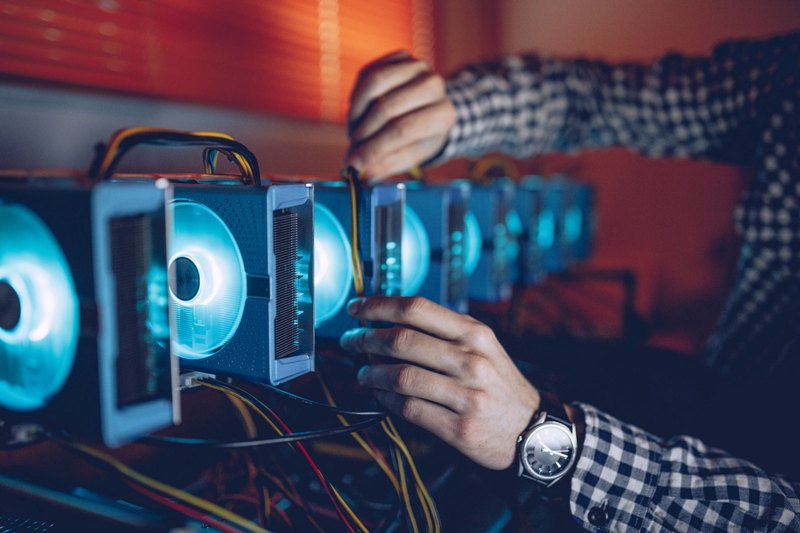

The bitcoin miners are the ones who create bitcoin and then are processed with the digital currency norms with huge amounts of calculations that work behind every transaction in it. You need a good level of energy inputs, but as far as the miners are concerned, there are several miners that are seen boosting up with the robust kind of computer equipment that is seen in the process. The speed of mining bitcoin depends upon the way advanced chips are seen rigging in. The cost of the bitcoin is seen going up, and so is the profitability of mining. The fixed price of the mining process of making one bitcoin can range from 5k USD to more. It has boosted up the margin to a huge level giving the record revenue of 1.4billion USD. As a result, one can find the miners going high with more number of high-end chips and computers.

The issue is that even without adding up the demand from the miners of the digital currency, there seemed to be a semiconductor industry that is seen struggling a lot in the global shortage. This very pandemic is seen snow storming in areas like Texas that are seen firing with severe kind of disruptions in order to produce the supply chains. We see an added number of digital currency miners like digital yuan that are seen in the chip industry dealing with several crises from supplying different constraints that are seen with the shortage of high-end chips claimed the research. The end result that you get would make things simple for everyone.

The dearth of industries dealing with the same is affecting bitcoin in a big way. We see many auto companies like Volkswagen and Toyota taking the production down in terms of giving cars in the industry. There are several smartphone makers that are seen defying the new models and deferring the same. With the shortage of gaming chips, one can find several chipmakers to have come with the new chip that is seen coming with good mining efficiency with the help of lesser mining efforts. The companies like Samsung and TSMC are among the top chip makers companies in the world that are being used to mine digital currency in a big way. Despite the fact that these companies have a higher potential to deal with a higher number of supplies.

Apart from the specialised kind of chips, one can mind different miners coming up with different servers and computers that are seen pushing ahead with the traditional dram chips found in the PCs. It is not helping anyone to traditionally reach the peak season for the chips that are used in servers that remain crucial to the businesses found in the big tech groups like Facebook and Google. All these factors have helped to boost up the cost by 60% in the recent past few months. A number of these are boosted up with the chipmaker profits along with the shorter duration that is wreaking all havoc. In the recent past, we have seen chip prices coming down in a big way. In yet another 20 per cent of the chip coast hike, one can see more surge in the coming next quarter. The fact of the matter is the demand for digital currency seemed to have a good impact on the chip market, and it will soar in the coming times.