BTCC Bitcoin Futures Trading Day 14: $150 to $1,200

Brief Background

Towards the close of 2017, Bitcoin futures obtained approval from the SEC, and speculators jumped in. But what does it take for one to take on Bitcoin futures? You need a platform like BTCC offering Crypto-futures as one of the products.

Markets have grown, and BTCC is among the leading platforms. You can speculate on any asset among the top ten crypto assets, like BTC, ETH, XRP, LTC, BCH, and the list is increasing with time.

BTCC is an international platform. Those conversations in English, Korean, and Chinese can select their respective language of choice from the home menu.

Making $1200 is a Reality

I made that, and I’ll share the finer details with you. It seems like a case of hitting the jackpot twice.

Why?

The prices were on a descending channel. I was sure about the bearish rally but unaware as to when it’d hit my targets.

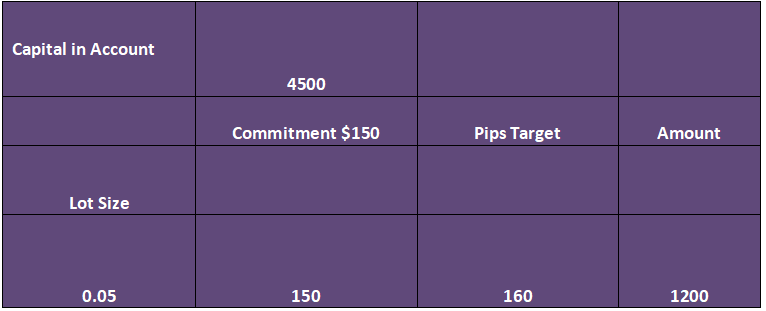

Day 14 – A whopping $150 turns$1,200

On 16 April 2021, my Bitcoin futures shorting contract opened, and within a glimpse of a day, it did get me an astounding $12,000.00.

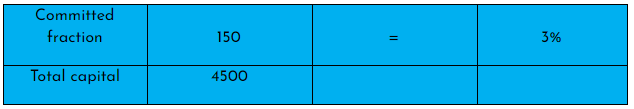

Chasing the trends and greed are a recipe for blowing your account. If you look at my details above, I commit a tiny fraction of my account, only three percent.

I’m aware you wonder why I captured just a few pips and left the several others hanging from that Bitcoin bearish pull-back. And here’s how I can best say it from my experience:

- Steer away from greed, have targets and once you hit them, walk away from the screens and charts.

- Never chase the markets. Let them come to you.

My target was clear, $ 1200, and it happened with twelve hours spun.

Following greed would have seen me chase the markets to the lowest point. The catch is it will trick me into increasing lot size among other mind-grilling experiences.

Chasing the trends and greed are a recipe for blowing your account. If you look at my details above, I commit a tiny fraction of my account, only three percent.

The significant point is never committing past five percent of your account if you are starting. For my case, the three percent is relatively high, but I waited for this opportunity for over three months. And I get to sleep peacefully. I do not have the robot power to keep my eyes glued to the screen for over 48 hours. And neither do I have to fear a massive loss of my capital. That’s how low leverage works for you instead of against you.

YOU MAY LIKE: Bitcoin Leverage & Margin Trading: How to Do It Right in 2021

Increasing Capital and Earning Profits on BTCC

The reality is that bad trades happen, but not at a rate that will blow my account. It’s great when you cover a position with a stop loss instead of leaving it open. My belief is, I can recover stop losses with one colossal win. Keep growing my account by winning more than losing.

Speculating with the Trend and the Sentiment in Mind

Speculating with Bitcoin futures is almost similar to what Forex traders do. Risks facing online traders apply to digital assets as well as their risk management tools.

However, one undisputed arena that has helped many speculators is working along with the trend. Many also refer to it as trending with the trend. Trend analysis depends on the timeframe of your speculations.

What time spans are you opening and closing contracts?

Is it every five minutes, every hour, every four hours, days, or weeks?

With a precise time frame, you can proceed to pull its respective chart. And you’ll get either of these three results: uptrending, downtrending, or ranging/choppy markets.

Another handy point: how do you open and close winning contracts. I boost my chances of making a win by reading sentiments from credible analysts. Fact is, no one is perfect with predicting price direction and volatility.

Speculating with sentiment requires discipline and relative flexibility. It boils down to one thing- price direction prediction by experts on Bitcoin futures? Read from 3 or 4 trusted experts. Mostly they predict on daily or weekly posts. Mostly, the approach to sentimental briefs is either from technical or fundamental analysis. Also, bear in mind – sentimental analysis has no analytical tools per se and is mostly very informed hearsay.

A good example is a pullback by Bitcoin for the second half of April 2021. After hitting the $ 64,000 at the close of quarter 2, sentiments were clear, BTC bullish cycle was almost ending. The reality is, in the first month of quarter two alone, Bitcoin made a massive pullback. Also, a month later, the Bitcoin price was hitting as low as $48,000. Again, by the close of April and into early May, BTC was up-trending and almost retaking the $ 58,000 mark.

Therefore, apart from the trend, understanding sentiments helps risk-takers mitigate the probability of losses.

BTCC Platform Pro-Points

BTCC has existed since December 2011. All this long, I’ve never spotted any flay in the security models of the platform. It’s only out of curiosity that I got the background to it. The platform has automated and independent audit logs. That must be the latent bullet the developers use to keep robust asset security, a variable where many other giants have dismal scores.

For Bitcoin futures, BTCC allows you to leverage 150X, where most peers limit that at 100X.

BTCC as a platform runs all transactions on a Stablecoin – USDT or Tether, which helps in valuation and limiting volatility. At any time, you can give a credible estimate of how much worth you are in USD.

In Summary

Speculating on Bitcoin futures is becoming a mainstream form of investment. It could be you do not own Bitcoin or any other digital asset. The point is you must not own a digital asset to stake on its futures products.

Taking the time to horn your skill in speculation is a handy investment in self-development. And with the growth in digital assets over time, the opportunities at your disposal become a limitless array.

Go For A Free Account In Seconds At BTCC And Try Your First Bitcoin Futures Trading Today. New Users Will Receive Up To 2,000 USDT Trading Bonus!